Post

by fatguyslim » Sun Apr 22, 2018 1:58 am

Hey everyone, I have some questions about the Business Activity documents. Any help will be greatly appreciated. Thanks in advance

So this is what the guidance notes says

(b) If you are a director of a UK company or member of a UK partnership, you must provide:

(i) printouts of Companies House documents, dated no earlier than three months before the date of the application, showing all of the following:

(1) the address of the registered office in the UK, or head office in the UK if it has no registered office,

In June 2016 I changed the registered address of my company so I take it providing a copy of IN01(ef) with the AD01(ef) document will do? Unless there is something else, then please let me know.

(2) your name, as a director or member,

I changed my service address in September 2017 so I take it I have to provide IN01(ef) with the CH01(ef) for this one?

(3) the date of your appointment as a director or member, and

I believe the IN01(ef) covers this too unless there is something else required then please let me know

(4) that the business is actively trading (not dormant, struck-off, dissolved or in liquidation),

Not sure what document I can give for this other than the recent confirmation statement CS01(ef) document?

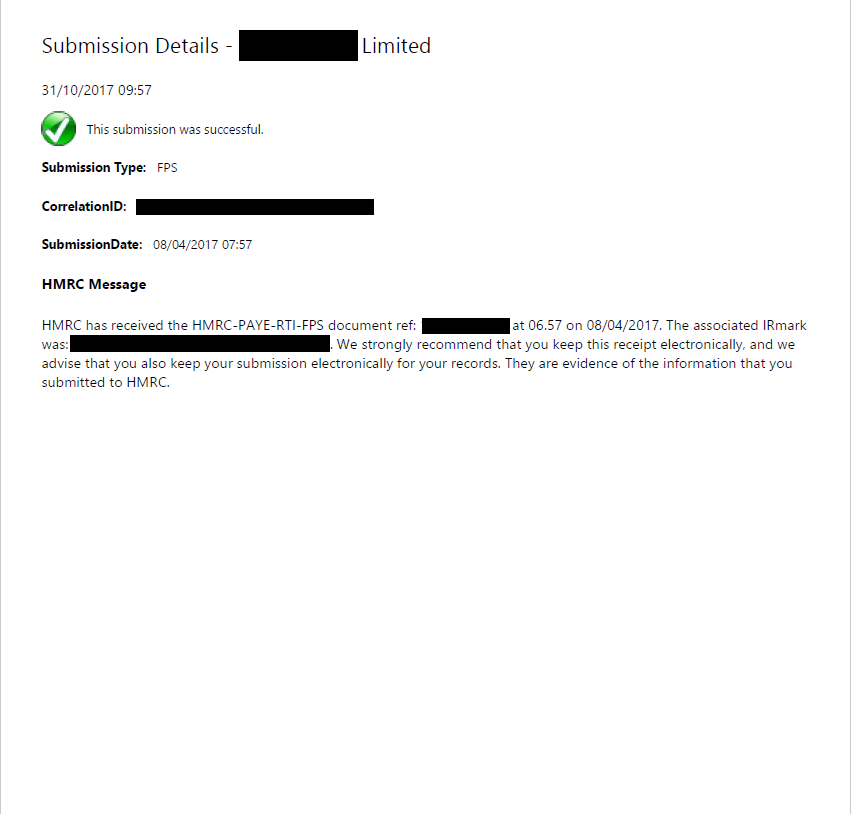

(ii) HM Revenue & Customs’ confirmation or equivalent evidence that the company is

registered for corporation tax (if you are a director of the company), or that you are making tax returns within the self-assessment tax system (if you are a member of a partnership), and

Please can you let me know what document I need for this so I can get my accountant to sort it out? Thanks

(iii) a business bank statement from a UK account which shows business transactions or a letter from the UK bank in question on its headed paper, confirming that the company or partnership has a bank account, that you are a signatory of that account, and that the company or partnership uses that account for the purposes of their business.

This is easy enough to do