Moderators: Casa, archigabe, CR001, push, JAJ, ca.funke, Amber, zimba, vinny, Obie, EUsmileWEallsmile, batleykhan, meself2, geriatrix, John, ChetanOjha, Administrator

-

sumannath

- Newbie

- Posts: 32

- Joined: Mon May 15, 2017 2:25 pm

- Mood:

Post

by sumannath » Sun May 03, 2020 9:31 pm

Hi folks

I'm currently on my first FLR(M)and recently found out that my Mrs and I are exempt from paying council tax since I'm a non-EU citizen and my spouse is British and a full-time student, so I requested the City of Edinburgh Council for council tax refund since we have been paying council tax for the last 2.5 years after our marriage and they refunded us back the amount we have paid in the last 2.5 years. Does this count as 'Receiving Public Funds'? Please let me know.

Thanks,

Suman

-

seagul

- Diamond Member

- Posts: 10201

- Joined: Thu Nov 12, 2015 11:23 am

- Mood:

Post

by seagul » Sun May 03, 2020 10:15 pm

Although it won't be classified as claiming public funds but I don't think so you would be exempted from council tax liability. Because a full council tax bill is usually based on 2 adults living at a property and in case of a couple both are jointly responsible over this liability. However, there might be some discount which most often varies from one council to another. You should fully declare your circumstances to local council with a view to receive the correct bill because if the authorities find out later any discrepancy then may penalize you. Normally a full council tax is only exempted where everyone living in the home are a fulltime student.

The opinion expressed as above is neither a professional advice nor contesting/competing to other member's opinion/advice.

-

JB007

- - thin ice -

- Posts: 1745

- Joined: Sun Jan 20, 2019 2:14 pm

Post

by JB007 » Mon May 04, 2020 10:36 am

sumannath wrote: ↑Sun May 03, 2020 9:31 pm

Hi folks

I'm currently on my first FLR(M)and recently found out that my Mrs and I are exempt from paying council tax since I'm a non-EU citizen and my spouse is British and a full-time student, so I requested the City of Edinburgh Council for council tax refund since we have been paying council tax for the last 2.5 years after our marriage and they refunded us back the amount we have paid in the last 2.5 years.

Have you/your wife, told the council you are living there?

If there are only two adults living at the property and your British citizen wife is a student, then you are liable for all of the council tax. You could apply for a 25% single person discount on that bill.

"We may offer

a 25% discount if all but one of the adults living at the property are students

a 100% exemption if the property is occupied solely by students.

This discount reduces your Council Tax, water and sewerage charges."

https://www.edinburgh.gov.uk/discounts- ... discount/1

If council tax isn't paid in full, Edinburgh, like many other councils and benefit agenies, look for data footprints to stop fraud.

"The City of Edinburgh Council in partnership with Northgate Public Services are undertaking an evidence based single occupancy discount review. This uses a combination of information held by the Council, third party data sources and specialist validation services."

https://www.edinburgh.gov.uk/discounts- ... discount/1

-

JB007

- - thin ice -

- Posts: 1745

- Joined: Sun Jan 20, 2019 2:14 pm

Post

by JB007 » Mon May 04, 2020 10:51 am

seagul wrote: ↑Sun May 03, 2020 10:15 pm

You should fully declare your circumstances to local council with a view to receive the correct bill because if the authorities find out later any discrepancy then may penalize you. Normally a full council tax is only exempted where everyone living in the home are a fulltime student.

I think I might have read that someone on a Tier 4 dependant visa does not have to pay council tax (not sure about this) but that does not apply to the OP.

If the OP has told the council he lives at the property (which they must do) then he needs to make it clear that he in not a student and that his student wife is a British citizen. Then ask for the 25% single discount off that bill.

-

seagul

- Diamond Member

- Posts: 10201

- Joined: Thu Nov 12, 2015 11:23 am

- Mood:

Post

by seagul » Mon May 04, 2020 1:47 pm

JB007 wrote: ↑Mon May 04, 2020 10:51 am

. Then ask for the 25% single discount off that bill.

Not sure as how the op will qualify for 25% discount unless the op's partner isn't counted as an adult.

Who has to pay

You’ll usually have to pay Council Tax if you’re 18 or over and own or rent a home.

A full Council Tax bill is based on at least 2 adults living in a home. Spouses and partners who live together are jointly responsible for paying the bill.

You’ll get 25% off your bill if you count as an adult for Council Tax and either:

you live on your own

no-one else in your home counts as an adult

Who does not count as an adult?

These people are not counted as adults for Council Tax:

children under 18

people on some apprentice schemes

18 and 19-year-olds in full-time education

full-time college and university students

young people under 25 who get funding from the Skills Funding Agency or Young People’s Learning Agency

student nurses

foreign language assistants registered with the British Council

people with a severe mental impairment

live-in carers who look after someone who is not their partner, spouse, or child under 18

diplomats

The opinion expressed as above is neither a professional advice nor contesting/competing to other member's opinion/advice.

-

CR001

- Moderator

- Posts: 89202

- Joined: Thu Mar 08, 2012 10:55 pm

- Location: London

- Mood:

Post

by CR001 » Mon May 04, 2020 1:51 pm

seagul wrote: ↑Mon May 04, 2020 1:47 pm

JB007 wrote: ↑Mon May 04, 2020 10:51 am

. Then ask for the 25% single discount off that bill.

Not sure as how the op will qualify for 25% discount unless the op's partner isn't counted as an adult.

Who has to pay

You’ll usually have to pay Council Tax if you’re 18 or over and own or rent a home.

A full Council Tax bill is based on at least 2 adults living in a home. Spouses and partners who live together are jointly responsible for paying the bill.

You’ll get 25% off your bill if you count as an adult for Council Tax and either:

you live on your own

no-one else in your home counts as an adult

Who does not count as an adult?

These people are not counted as adults for Council Tax:

children under 18

people on some apprentice schemes

18 and 19-year-olds in full-time education

full-time college and university students

young people under 25 who get funding from the Skills Funding Agency or Young People’s Learning Agency

student nurses

foreign language assistants registered with the British Council

people with a severe mental impairment

live-in carers who look after someone who is not their partner, spouse, or child under 18

diplomats

@ Seagul, it does clearly state full-time college and university students (regardless of age)!!!

Char (CR001 not Casa)

In life you cannot press the Backspace button!!

Please DO NOT send me a PM for immigration advice. I reserve the right to ignore the PM and not respond.

-

seagul

- Diamond Member

- Posts: 10201

- Joined: Thu Nov 12, 2015 11:23 am

- Mood:

Post

by seagul » Mon May 04, 2020 2:10 pm

CR001 wrote: ↑Mon May 04, 2020 1:51 pm

seagul wrote: ↑Mon May 04, 2020 1:47 pm

JB007 wrote: ↑Mon May 04, 2020 10:51 am

. Then ask for the 25% single discount off that bill.

Not sure as how the op will qualify for 25% discount unless the op's partner isn't counted as an adult.

Who has to pay

You’ll usually have to pay Council Tax if you’re 18 or over and own or rent a home.

A full Council Tax bill is based on at least 2 adults living in a home. Spouses and partners who live together are jointly responsible for paying the bill.

You’ll get 25% off your bill if you count as an adult for Council Tax and either:

you live on your own

no-one else in your home counts as an adult

Who does not count as an adult?

These people are not counted as adults for Council Tax:

children under 18

people on some apprentice schemes

18 and 19-year-olds in full-time education

full-time college and university students

young people under 25 who get funding from the Skills Funding Agency or Young People’s Learning Agency

student nurses

foreign language assistants registered with the British Council

people with a severe mental impairment

live-in carers who look after someone who is not their partner, spouse, or child under 18

diplomats

@ Seagul, it does clearly state full-time college and university students (regardless of age)!!!

Thanks for correction as I misjudged it as whether it might be only for 18-19 old ones.

But op won't be completely exempted and if he has received the whole amount of refund then authorities either misconstrued him a student as well or might have considered that only her student wife is the only occupant there.

The opinion expressed as above is neither a professional advice nor contesting/competing to other member's opinion/advice.

-

sumannath

- Newbie

- Posts: 32

- Joined: Mon May 15, 2017 2:25 pm

- Mood:

Post

by sumannath » Sun Jun 14, 2020 11:00 am

Hi,

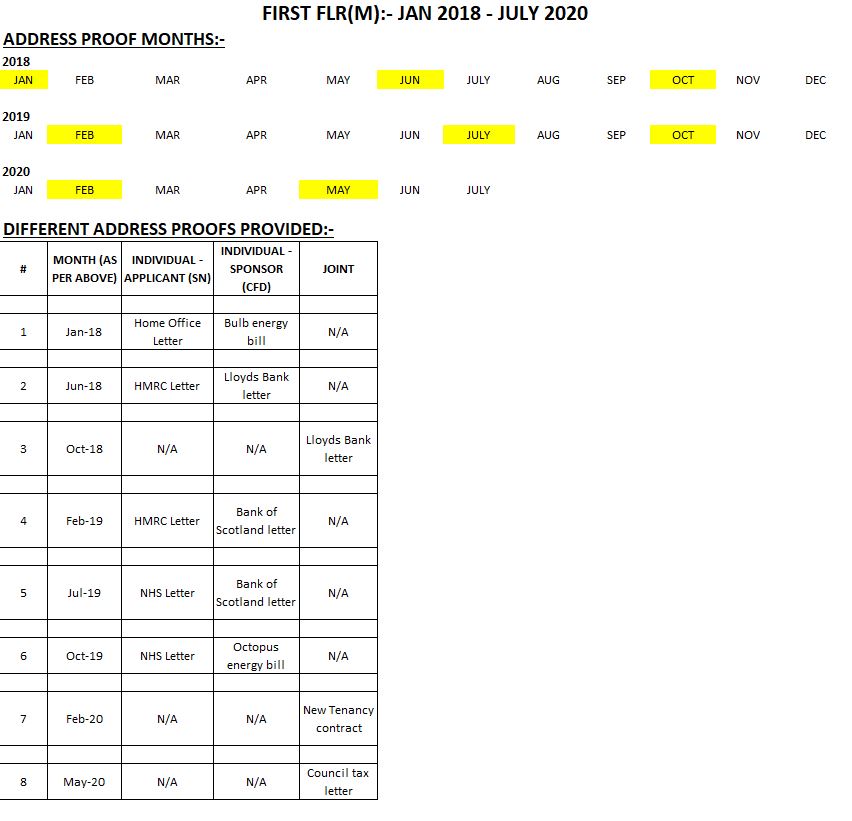

I will be submitting my first extension application towards the end of this month since my first FLR(M) expires on the 24th July. I have compiled a list of address proofs that I intend to submit. See attached photo. Please let me know if it looks OK / NOT OK to you (if not ok then please state the reasons).

Thanks.

-

Attachments

-

- IMG-20200614-WA0002.jpg (74.43 KiB) Viewed 676 times

-

seagul

- Diamond Member

- Posts: 10201

- Joined: Thu Nov 12, 2015 11:23 am

- Mood:

Post

by seagul » Sun Jun 14, 2020 12:43 pm

sumannath wrote: ↑Sun Jun 14, 2020 11:00 am

Hi,

I will be submitting my first extension application towards the end of this month since my first FLR(M) expires on the 24th July. I have compiled a list of address proofs that I intend to submit. See attached photo. Please let me know if it looks OK / NOT OK to you (if not ok then please state the reasons).

Thanks.

Seems fine.

The opinion expressed as above is neither a professional advice nor contesting/competing to other member's opinion/advice.

-

sumannath

- Newbie

- Posts: 32

- Joined: Mon May 15, 2017 2:25 pm

- Mood:

Post

by sumannath » Sun Jun 14, 2020 5:28 pm

Thanks very much.

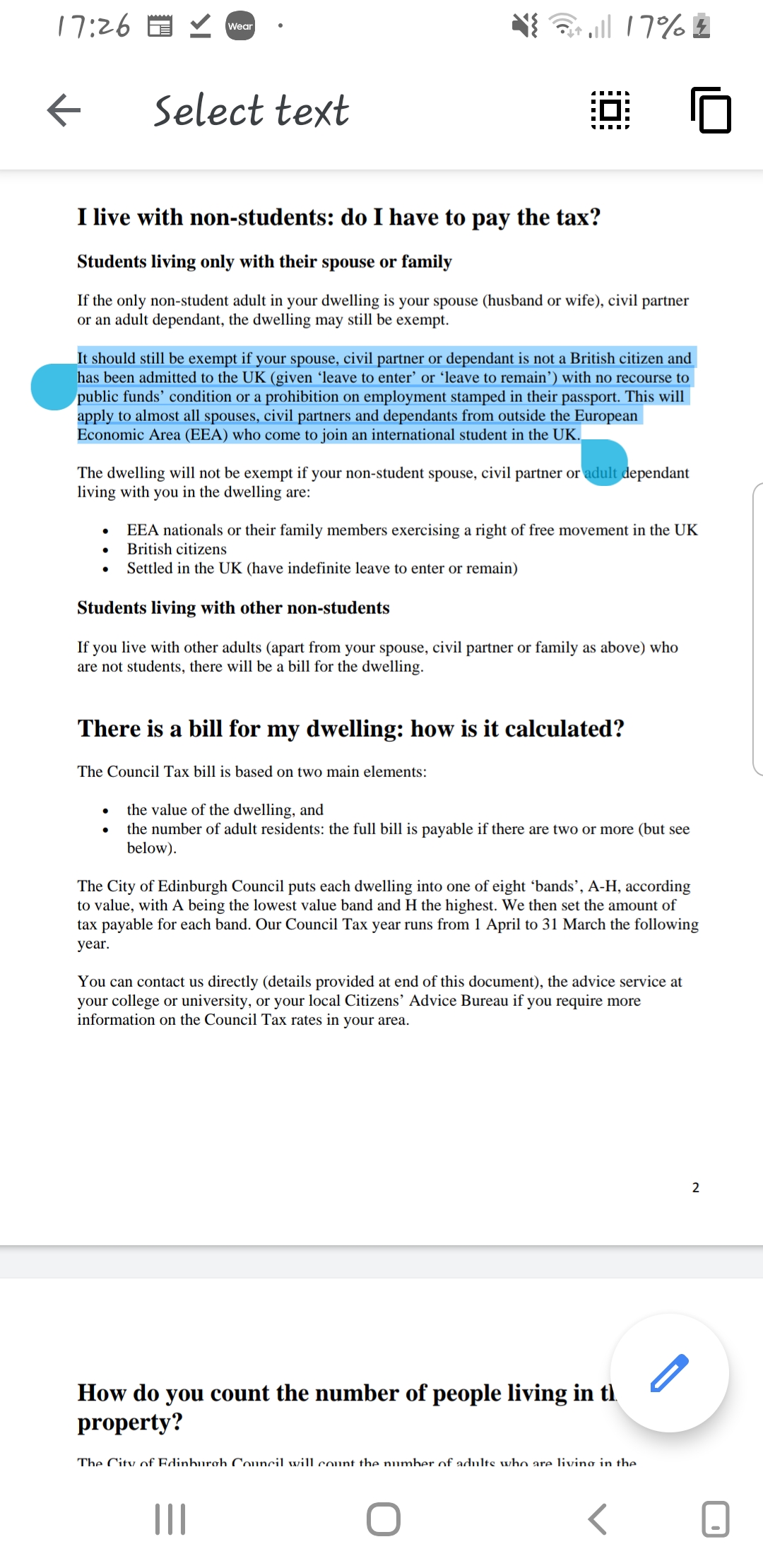

On a different note, referring back to my previous post on council tax exemption. I have confirmed it with City of Edinburgh Council that my Mrs and I are both exempt from council tax since I'm a non EU national and married to a British citizen who is a full-time student. See attached excerpt from City of Edinburgh Council's guidelines for council tax exception.

-

Attachments

-

- Screenshot_20200614-172624_Drive.jpg (673.64 KiB) Viewed 651 times